Your Ultimate Guide To Optimizing Your Final Expense Life Insurance Leads

Are you a brand spanking new to Final Expense Life Insurance sales, and health insurance sales, or are you a professional looking for opportunities? Are you looking to get your feet wet by leveraging discounted aged Final Expense Life Insurance leads? All without burning holes in your pockets! We’ve got you covered. Here we’ve created a complete guide on how to sell Final Expense Life Insurance. Let us walk you through the process of purchasing Aged Final Expense Life Insurance leads, targeting new leads, qualifying prospects, and even closing the sale.

Though you’ve likely read several comprehensive guides on selling Final Expense Life Insurance online, we want to stress that speed and efficiency are crucial if you’re going to succeed in today’s marketplace. Even if you have the best leads on the market (*cough* ours, *cough*), your sales plan must take in the volume of leads and prospects you need. Otherwise, you’ll end up stressed and burned out. Likely way behind on your close target rate (and need a Final Expense Plan yourself.) So, keep reading as we give you tips to help you streamline your sales funnel so that you can sell Final Expense Life Insurance or health insurance more efficiently.

You can even see our Final Expense Life Insurance Leads Script and suggested approach here.

Aged Final Expense Life Insurance Leads – Here’s What You Need To Know

Final Expense Life Insurance is not always at the forefront of people’s minds…till it’s too late.

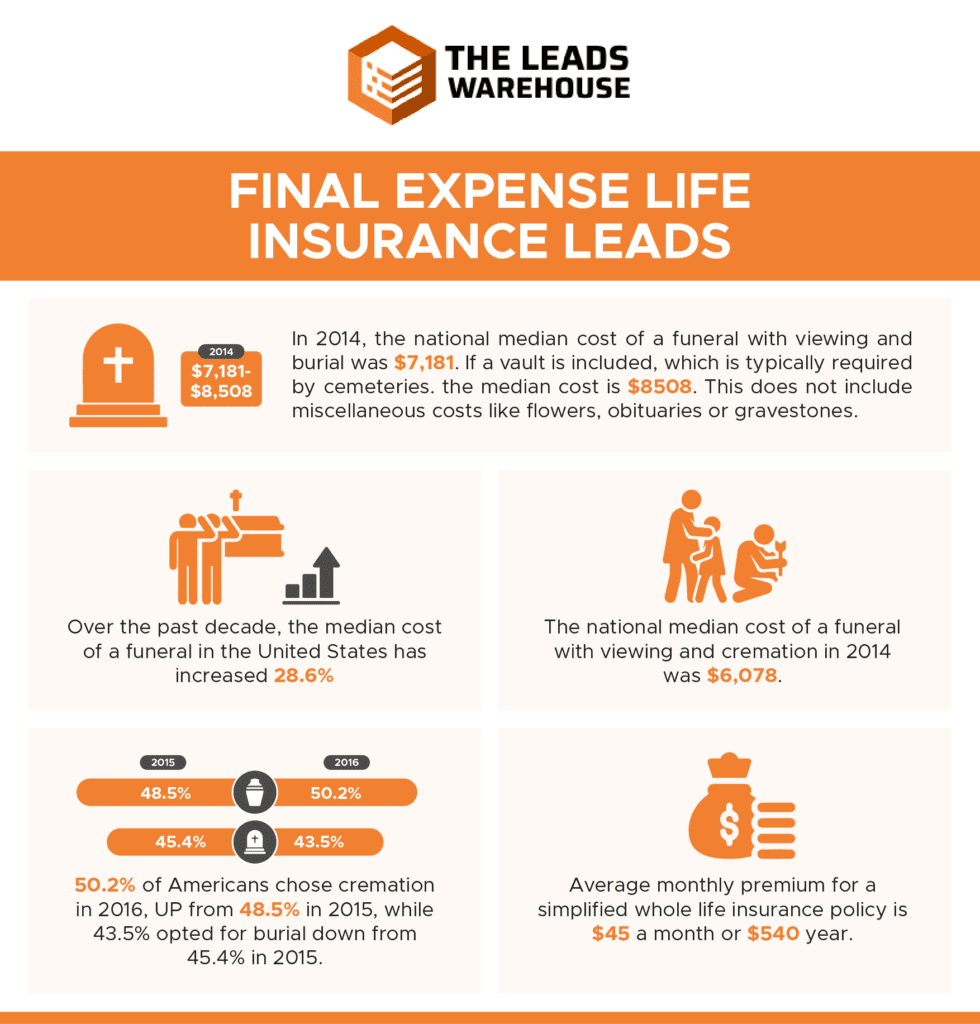

As family members pass away and people get older, they start to think about the impact they will have on the people around them (unlike most of their lives). Your target customers likely are those who want to leave behind an inheritance for their children or partner. And Final Expense Life Insurance can give them the peace of mind they need. Final Expense Life Insurance is also a way to ensure that people won’t be leaving behind a pile of debt to their loved ones.

Did you know that only about 59% of Americans currently have any type of Life Insurance? Does this number seem low to you? It’s that low because most Americans don’t think they can afford a decent Final Expense Life Insurance policy, so they opt for nothing. The good news, you already know, Final Expense Life Insurance policies are much more affordable than they might think. Allowing you to make some money selling insurance to people who really need it. You might be precisely what people need if only you could find your target audience!

Let’s dive into what the target audience means. Who is Final Expense Life Insurance for?

Who Is Final Expense Life Insurance For?

Every single person who has family or next of kin can benefit from a Final Expense Life Insurance policy. But some specific people especially need it:

- Spouses who are the sole income earners for their family

- Adults with student loan debt (so…everyone)

- Business owners

- Older adults who have limited savings (also…everyone)

It’s likely that these specific people groups are already aware of their responsibility. And they may already be feeling the stress. As a Final Expense Life Insurance agent, it’s your job to give them peace of mind. So that they can feel better knowing their family and loved ones are covered if the worst-case scenario happens.

Make sure you develop a list of qualifying questions during your consultation with your prospect. You can determine which pain points are greatest and what events are triggering their worry. Remember, the baby boomer generation is reaching retirement every day. And you’d be surprised at how many seniors don’t have savings or adequate coverage. Your insurance policies may be exactly what they need right now. Every baby boomer is a potential Aged Final Expense Lead!

When you’re purchasing Aged final expense leads from The Leads Warehouse, you’ll easily be able to filter the leads you want by age or other qualifications, which can help you narrow your prospects and find the leads you really want.

Strategies to Sell Final Expense Life Insurance

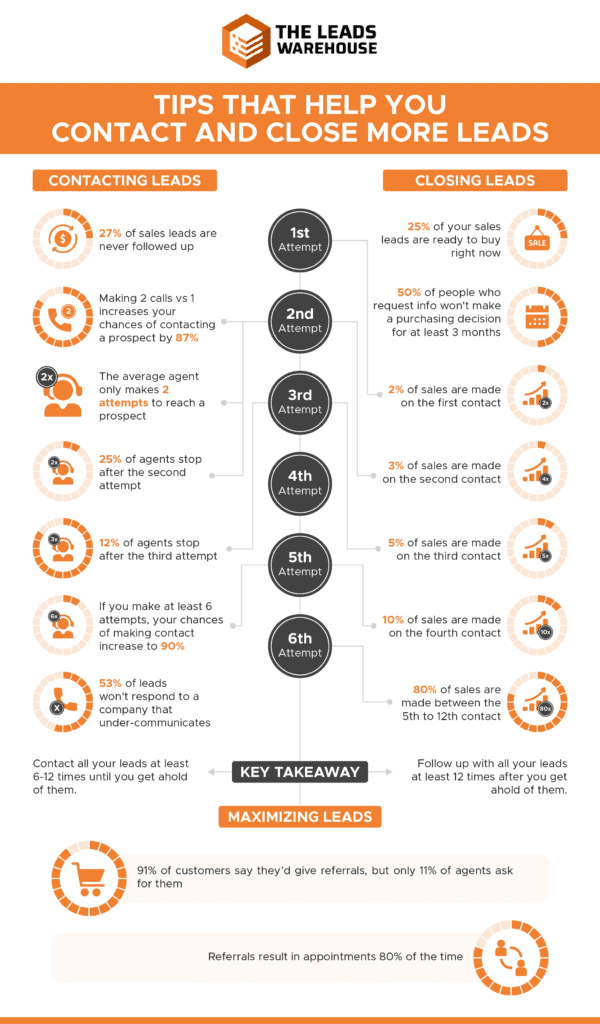

Every sales agent has a different approach, but at the end of the day, a slow and tedious process will frustrate your prospects and cost you sales. A quicker sales funnel is about working smarter, and making the entire prospect faster and easier for your clients. When you target the right leads, ask the right questions to qualify them. And know when to close, you’ll be more successful because you won’t be wasting time on leads that aren’t going anywhere.

Of course, planning your sale strategy all depends on having aged final expense leads to call and follow up with! Don’t spend all of your time and resources generating your own leads. Instead, go with a more efficient and cost-effective option, purchasing Final Expense Life Insurance leads in bulk to help you build your list in your CRM.

How to Generate Final Expense Life Insurance Leads

If you’re just getting started selling Final Expense Life Insurance, you might be feeling like you’re grinding more often than selling. Are you only using and contacting leads that are generated by your insurance agency? There are other, more efficient ways to bring in potential leads and find new clients that will actually lead to sales. Like popping out of a coffin in front of prospects’ homes…just kidding…don’t do that.

Purchasing aged final expense leads in bulk can give you a leg up on your competition and maximize your efforts. Bulk Final Expense Life Insurance leads boost your pipeline with hundreds of qualified quality leads that you can start calling immediately. Though hopefully, you have marketing strategies in place to generate your own leads. When you focus on this too much, you can end up wasting both time and money. You’re a salesperson, not a marketing genius (like us). So leave that to the experts and filter your leads so that you can make more sales.

How to Target the Right Leads

How broad is your marketing strategy, Stevie Wonder or Superman? Are you targeting the right people who will actually buy an insurance policy? More often than not, people are requesting quotes for Final Expense Life Insurance leads because of a change in their life. They could have just married, had a baby, and started a new career with a significant raise. Alternatively, a sudden death of a friend or family member may prompt this reflection on life after they’re gone. Your lead generation efforts should focus on people who might be dealing with life-changing events because they are much more likely to convert.

Qualifying Prospects

We’ve mentioned qualifying prospects already, but it really is important to know the origin of your prospect’s motivation. Knowing why they want a Final Expense Life Insurance policy is key to closing the sale. With aged final expense leads, you know they already spoke to someone, and are probably already qualified!

When talking with your lead, ensure your sales process allows you to take detailed notes for each call in your CRM software. Record names, important details, and more to stay prepared and informed for every call. Having these details handy will help you build trust between you and the prospects.

See our Final Expense Life Insurance Leads Script and suggested approach here.

Closing Sales

Whether you’re the Wolf of Insurance Street or just getting started, you’ll already know that agents listen a lot more than they talk. You’ll have qualifying and follow-up calls that include a lot of questions to find out what your potential client really needs.

Find out what really motivates each specific prospect. Maybe their reason for needing insurance goes beyond just protecting their family in case the worst happens. He might have interested in having a highly customized solution with monthly or yearly payment schedules. The sooner you find out his objections and get down to pinpointing his needs, the faster you’ll be able to close another sale.

Mastering the relationship and getting what you need from your prospect takes skill and practice. But as you do it more, it becomes easier, and you’ll make those deals faster, bringing you closer to a Bahamas vacation.

Conclusion

Successful health insurance agents and Final Expense Life Insurance agents find that selling to qualified aged final expense leads is a really rewarding career choice. Though there may seem to be countless ways to go about selling to Final Expense Life Insurance leads. However, optimizing your efforts will prevent burnout and discouragement.

We think that success can come without working yourself to death. It’s about working smarter and finding ways to be more efficient. Learn how to quickly qualify and move aged final expense leads through your funnel and utilize lead-buying and automation strategies which will lead to more closing sales. Today is the day to start utilizing The Leads Warehouse. We pride ourselves on being a lead generation company that thinks outside the box. We have unique filtering options so that you can target the specific demographic that you want.

The hardest part of building your business is getting customers in the door and in front of you. Our Final Expense Life Insurance leads list improves your chances of customer conversions and ROI, as you can handpick quality leads ready to close deals!

Want to learn more? Start here!