By James Schulze

This article discusses the Federal Reserve’s federal funds rate and the upcoming reductions we may see based on the FOMC’s recent projections. This is good news for the mortgage industry, as lower interest rates often drive more activity.

By now, you have likely heard that the Federal Reserve recently reduced the federal funds rate by 50 basis points, bringing the target rate between 4.75% and 5.00%. When the federal funds rate falls, other interest rates tend to follow. Since the mid-September announcement, some mortgage interest rates have bounced slightly down and even up a bit. Financial experts claim more adjustments in the Fed’s rate may be needed to create a bullish environment in the mortgage industry over the next few years. But how big of an adjustment is likely? And when?

When the Fed will next meet to discuss the federal funds rate

The federal funds rate is set in conjunction with the Federal Reserve’s Federal Open Market Committee (FOMC). The committee is scheduled to meet two more times before the end of 2024. The December 17-18 meeting is associated with a Summary of Economic Projections (more on this in a moment). In 2025, similar such meetings will be held on March 18-19, June 17-18, September 16-17, and December 9-10.

What the FOMC’s Summary of Economic Projections tells us

The Summary of Economic Projections gives us a glance into the FOMC’s thinking on the economy and the path for the federal funds rate. Federal Reserve Board members and Federal Reserve Bank presidents submit their projected likely outcomes for key economic measures (i.e., GDP growth, unemployment rate, inflation) as well as the trend for the federal funds rate. These projections cover the current year, each of the next three years, and a longer run estimate. Updated four times per year, they are based on information available at the time and members’ assessment of appropriate monetary policy. While unforeseen shocks to the economy could happen and change the outcomes of these measures, these figures give us insights on likely trends.

FOMC’s most recent projections for the federal funds rate

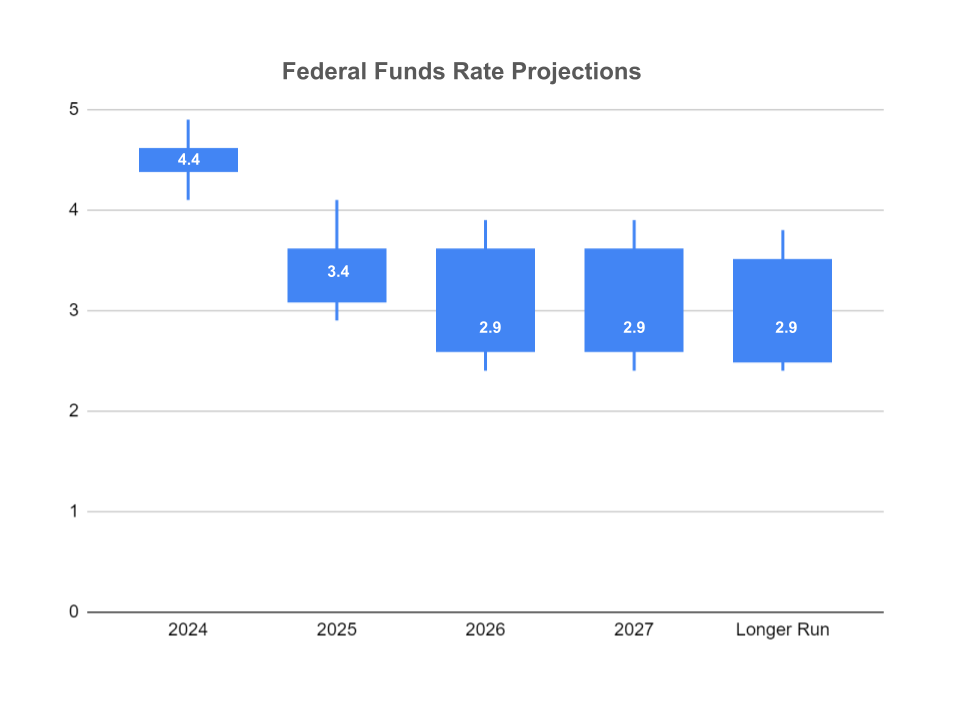

So, back to the good news at hand. The FOMC’s most recent projections suggest the federal funds rate will continue to be lowered over the next couple of years. FOMC members projected the federal funds rate will be:

- Reduced to a median of 4.4% by the end of 2024, well under the current target range of 4.75-5.00%.

- Decreased one full percentage to a median of 3.4% by the end of 2025

- Further lowered 50 basis points to a median of 2.9% by 2026 year end.

What this means for the mortgage industry

While no estimates come with 100% certainty, it is clear that the FOMC is eyeing some significant downward shifts in the federal funds rate. Some mortgage interest rates will likely follow this trend, creating a strong demand for home purchases and refinancing.

As a general rule, homeowners often consider refinancing when they can reduce their interest rate by 2%. It may even make sense with a downward adjustment of 1%. The federal funds rate was just over 5.3% during the early months of 2024. The FOMC’s newest projections suggest that we may see an approximate 1% decrease in 2024 (4.4%) and a 2% reduction by the end of 2025 (3.4%). If mortgage rates lower, and it is likely they will, we should see an uptick in refinancing in 2025.

Individuals looking to purchase a home will also be encouraged by lowering interest rates, which have been running above 6%. More home sellers will likely enter the market too, creating more supply to meet the demand. More than 6 million homes were sold in the U.S. in 2016 and again in 2017 when average mortgage rates were below 4%. When the average mortgage rates climbed to more than 6% in 2023, the number of homes sold dipped to just over 4 million. A 2%-3% change in mortgage rates can clearly make a huge difference. Forecasts for 2025 suggest a recovery is in the making, with expectations of 5.3 million homes sold in the U.S. Good news for the mortgage industry.

Get ready for the recovery

To ensure mortgage companies gain traction in this recovery, they will need to identify current and potential homeowners who are interested in purchasing a home or refinancing. This can take significant time and effort. Mortgage companies who gain support in this area can fully focus their sales teams on closing deals. Aligning with a reputable leads provider such as The Leads Warehouse can help you effectively meet your sales expectations.

If you would like more information on how you can grow your mortgage sales during this recovery, give The Leads Warehouse a call at 1-800-884-8371 or visit our website at https://theleadswarehouse.com.